Updates and Typos

This page applies only to the first edition. The open access, second edition, MicroExcel.pdf, will be updated and corrected as soon as any mistakes or typos are found. I would appreciate notification if you have a correction or suggestion.

This page maintains a list of errata for the printed book. Corrections and updates of the Excel workbooks are included in the latest versions of the files.

p. 30: The first rule should be ln(xy) = y ln x, i.e., x to the y power, not simply ln(xy) as it is in the book.

p. 51: The chain rule example at the top of the page is (x^2)^3 so that is x^6 and d/dx is 6x^5. The book says d/dx((x^2)^3) = 3(x^2)*2x = 6x^3 -- this is wrong because it is missing a "^2" term after (x^2). It should be d/dx((x^2)^3) = 3(x^2)^2*2x = 6x^5. (Thanks to Prof. Huang for catching this one.)

p. 94: Second paragraph from the bottom should end with "in the endogenous variable" not "in the exogenous variable." (Thanks to Thomas Venus.)

p. 105: "At m=50, the income elasticity of x1* = (0)(140/6.25) = 0" should be "at m=140" since this value of income is the initial value . This doesn't make any difference in this case since the income elasticity is zero at m=50 and m=140. (Thanks to Aileen Hoffman.)

p. 106: Last paragraph should be "a horizontal line at 6.25" not 25 and again 6.25, not 25 in the next sentence. (Thanks to Thomas Venus.)

p. 152: The substitution and income effects should be switched in the penultimate paragraph. So, the book says, "The substitution effect is 16 2/3 - 20 5/6 = - 4 1/6. The income effect is 20 5/6 - 25 = - 4 1/6." It should say, "The income effect is 16 2/3 - 20 5/6 = - 4 1/6. The substitution effect is 20 5/6 - 25 = - 4 1/6." (Thanks to Prof. Heavey's students, Chris Busuttil and Max Fink and his student assistant Yang Li for pointing this out.)

p. 179: The constraint is missing a (1 - TaxBreak) term, so it should be: (1 - TaxBreak)BeneficiaryCon + p2DonorCon <= (1 - TaxBreak)m1 + p2m2. I corrected this equation in the Excel workbook.

p. 306: In the first Step, the yellow-backgrounded cell is actually P8, so it should say, "take a look at the highlighted cell (P8)" not P7. (Thanks to Shuqi Li.)

p. 311: I switched the key relationship between average and marginal cost. The book says, "Whenever an average curve is above the marginal curve, the marginal curve must be rising. Conversely, whenever the average is below marginal, the marginal must be falling." That is not right.

Here is the correct statement: "Whenever a marginal curve is above an average curve, the average curve must be rising. Conversely, whenever the marginal is below the average, the average must be falling."

p. 337: The 4th equation should be min AVC not min TVC. (Thanks to Ashley Wong and Lois Miller.)

p. 361: Near the top of the page, after computing L*=1431.414, we compute maximum profits, but there is a stray 0 in front of the first bracket. So, it should be [152.6842] not 0[152.6842]. (Thanks to Drake Yeiter.)

p. 362: Under "max," at the very bottom of the page, instead of just "L," it should be "L, q" because the firm gets to pick both L and q as choice variables in the constrained version of the input profit max problem. Also, while not a mistake, I should have pointed out that an easy way to connect the shutdown rule on the input and output sides is to note that shutdown occurs when w > ARP(L), which can be rewritten as wL > TRP, which can be translated to the output side as TVC > TR and, dividing both sides by output, AVC > P. (Thanks to Prof. Widdows for this correction and suggestion.)

p. 386: In the second to the last paragraph, there is a missing "to" in the first sentence: "that can be used to derive the cost function.” (Thanks to Thomas Venus.)

p. 417: In the second Step statement: It should be: “In other words, enter 3750” instead of 5000. (Thanks to Thomas Venus.)

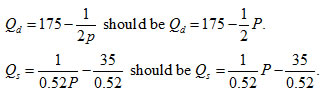

p. 431: The demand and supply functions derived from the given inverse demand and supply functions incorrectly have price in the denominator. Below, the equations on the left are shown as they are printed in the book, but they should have P as shown in the equations on the right. (Thanks, Rebeca.)

p. 433: In the first Step statement, it should be Pe = 100 and Qe = 125 instead of the other way around as it is in the book. (Thanks to Thomas Venus.)

p. 441: In the fourth Step statement: At Qd = 95, the price is 160, not 190. (Thanks to Thomas Venus.)

p. 446: Below the Step statement, the quantity demanded at $84.40 is 132.8, not 181.2, units. (Thanks to Thomas Venus.)

p. 458: "Although the red triangle that represents the deadweight loss is shorter (because the new equilibrium price is lower than before), it is much wider." The latter part is true, the triangle is wider because quantity falls by more when D is more elastic, but the the height of the triangle remains the same. The height is the amount of the tax and it is constant.

p. 491: In the last paragraph before the new section heading, there is a missing verb: “Coase argued that this was wrong.” (Thanks to Thomas Venus.)

p. 509: In the last sentence before the Exercises heading, delete the word "is": “It is also enables.” (Thanks to Thomas Venus.)

p. 534: Last sentence: “Similarly, A wishes to buy 6 and 2/3 of good 2…” instead of 66 and 2/3. (Thanks to Thomas Venus.)

Maintaining URLs

I am updating broken links in the printed book by including a short note in the Intro sheet of the accompanying Excel workbook. If you get a dreaded Error 404, please email me.

One especially valuable link that has moved is the excellent History of Economic Thought web site mentioned three times in the book (p. 143, p. 471, and p. 540). It is now here:

http://www.hetwebsite.net/het/

Last Update: 6 June 2020